UK Agencies Warn of Omnicom’s Post-Merger “Buying Power-House”

Earlier this month, Omnicom’s acquisition of rival advertising group Interpublic Group (IPG) received regulatory approval from the UK’s Competition and Markets Authority (CMA). On Tuesday the watchdog published its full decision, revealing the concerns raised by the companies’ competitors over the impact of the merger between the holding companies. Chief among them was the ability of the merged entity to procure media at scale at lower cost, which smaller competitors warned could pressurise them to match the competitive rates the company will be able to offer advertisers.

This dynamic has nuanced implications from a competitive perspective. By potentially driving down prices for advertisers, the CMA said price competition in the market would be strong and “perhaps even stronger” post-merger. For agencies the impact is more troubling. The concerns arise as agency fees face ongoing pressure from their advertiser clients, which has driven the use of principal or proprietary media, whereby agencies buy inventory from media owners at discounted rates then sell it onto their clients. Omnicom has a particularly active principal media business, which IPG’s CEO Philippe Krakowsky has said will help the agency’s own efforts to grow its proprietary media offering.

The CMA highlighted the importance of scale in securing favourable terms from media owners, including discounts or lower prices, lower commitments, and more favourable value pot attributions. And according to the decision, “all competitors that responded to the CMA’s information requests believed that the merged entity would use its increased scale to obtain better terms from media owners.” One submission said the merger would create a buying “power-house”, making it more difficult for smaller competitors to compete on price. Another competitor noted that the merged entity would gain significant advantage from its scale, allowing it to derive greater profit from the provision of media buying services (MBS).

Buying power

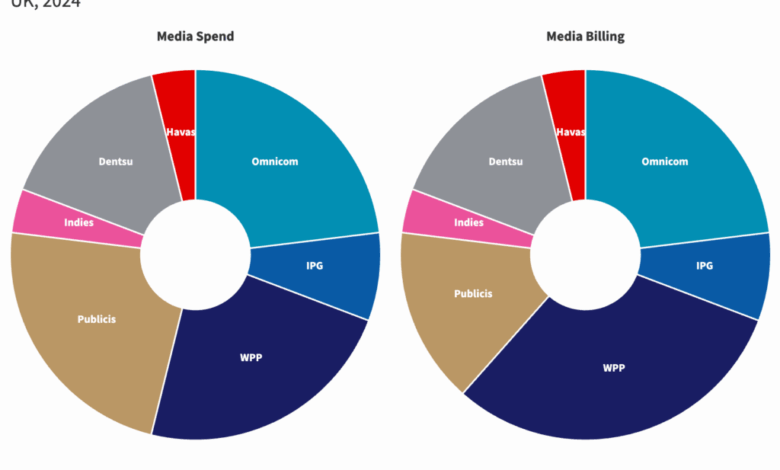

However, the CMA found that rival holding companies which also operate at scale have the same advantages, and would therefore act as constraints on the merged entity. The regulator invited third-party feedback from customers and competitors, asking them to rate the agency groups’ respective offerings. Several respondents described WPP’s and/or Publicis’ offerings as “very good” or “very strong”, suggesting the rival firms exert a strong constraint on the parties.

But the CMA’s analysis of the agencies’ share of media spend and billings are unlikely to appease competitors’ concerns around the merged entity’s buying power. Based on 2024 data, Omnicom is the second largest supplier of MBS in the UK, while IPG is the fifth largest. Combined, their media spend would command a 30-40 percent market share, outsizing those of WPP and Publicis. In terms of media billings however, the merged entity would take an equal share (30-40 percent) as WPP.

The evidence also indicated that Havas and Dentsu only exert a “moderate constraint” on the parties, with Dentsu’s being the stronger of the two. On average, customers identified Dentsu as having a moderate/good offering, and rated both Dentsu and Havas’ competitive strength as moderate.

Meanwhile independent agencies “exert a degree of constraint in parts of MBS”, particularly in niche sectors where they provide specialised services, or where customers are seeking more personalised attention within a smaller agency. The CMA also cited an IPG strategy document that explicitly notes two indies as a competitive threat, though the watchdog did not name the firms for reasons of sensitivity. But the constraint exerted by independent agencies is more limited in cases where advertisers require a global media buying strategy or have a high media spend, according to the decision.

The CMA concluded that the merged entity “would face competitive constraints from other providers of MBS, particularly from other holding companies.” It would also continue to be constrained by “a number of other large competitors, and to a lesser extent, smaller independent media agencies.”

But the regulator also stated that this decision was not an indicator of the outcome of all future merger investigations in the agency sector. The CMA said it heard several comments regarding the ongoing trend towards consolidation within the holding companies, and while market constraints proved sufficient in the case of Omnicom and IPG, the removal of competitive conditions may influence future decisions relating to mergers in the sector.

Follow VideoWeek on LinkedIn.