More US Ad Spend Comes Direct From Brands Than Through HoldCos as AI Reshapes Media Planning and Buying

Three months ago, Meta CEO Mark Zuckerberg sent shockwaves through the advertising industry with the suggestion that the tech giant’s use of AI will automate the entire campaign process, potentially making the current role of ad agencies redundant. While his comments sparked debate over the extent to which agencies will be displaced, it is clear that the holding companies will need to reposition their offering in an AI-driven ad market, and that shift is already underway at the major agency groups.

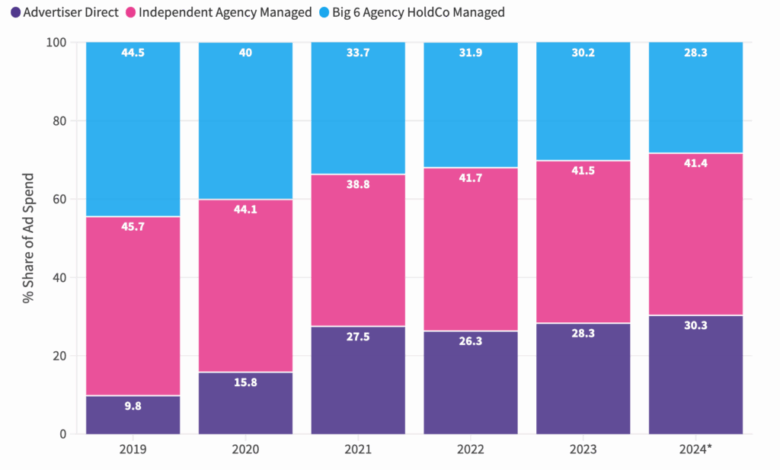

And their share of ad spend in the US was already being squeezed, even before Zuckerberg’s comments this year. New research from Advertiser Perceptions, a US-based market intelligence firm, shows the diminishing role of the holding companies in the total US ad market. In 2019, almost half of US ad spend came from the ‘big six’ holdcos. Over the next five years that proportion declined significantly, and the holdcos accounted for just 28 percent of ad spend in 2024 (the data covers the first three quarters of last year).

While the chunk of ad dollars managed by independent ad agencies has held relatively stable over the last six years, spend coming direct from brands has trebled since 2019, and advertiser direct spend now makes up 30 percent of the US market; higher than the proportion controlled by the holding companies. And while the holdcos “remain the gatekeepers to many of the industry’s largest budgets,” Advertiser Perceptions notes that they are no longer the only game in town.

How we got here

This shift was already in motion prior to the current wave of AI investment. The transition to programmatic marketplaces and automated campaign processes moved budgets towards walled-garden Big Tech platforms, which in turn offered advertisers tools that allowed them to bypass agency groups.

At the same time, economic pressures have forced advertisers to focus on lower-funnel and performance metrics to prove out ROI, and the walled gardens can provide that measurement (or at least their own version of measurement), compared to the harder-to-measure and longer attribution windows around brand-building. According to data from eMarketer, the ‘triopoly’ of Google, Meta and Amazon now take 58.8 percent of total US ad spend.

“It’s almost a guarantee that Google will hit your numbers,” comments John Bishop, SVP, Business Intelligence at Advertiser Perceptions. “They’re going to set up a program that will make sure that you hit your numbers.”

Agencies on the other hand tend to work in the upper-funnel space, while traditional brand-building channels such as TV are moving down the funnel through the digitisation of connected TV. But CTV poses hurdles to advertisers around fragmentation and measurement, and similar challenges persist in the retail media space.

“All these new tactics are following the digital promise, and it’s just easier to put that money in the triopoly, and have digital ads and banners and things like that be your key driver, or the biggest chunk of your media plan,” says Bishop. “That takes the creativity out of there, and that’s the threat to agencies.”

The SMB battleground

Meanwhile the tech giants’ investment in AI tools has made it even easier to reach small and medium-sized businesses (SMBs), which are helping to drive the share of brand direct ad spend in the US. Those companies “are finding the benefit of the long tail on Facebook,” according to Bishop, as the social media service offers the reach and scale they are looking for relative to their smaller budgets.

For other media owners, unlocking those SMB budgets poses more of a challenge. While broadcasters and streaming services are increasingly looking to reach SMBs, including by using AI to lower the cost of entry, those marketers remain sceptical over parting with sizeable chunks of their budgets, particularly given the fragmentation in the CTV market.

And the outreach required for media owners to forge relationships with SMBs also takes considerable investment. According to Advertiser Perceptions, there are around 24,000 people who directly influence advertising vendor selection at holdcos, compared with 680,000 marketing and advertising staff working directly for brands. “Media companies that want to access these budgets will need to invest in sales and marketing to reach these groups more effectively,” notes the research.

Where we’re going

That said, the vast majority of US marketers still used agencies for media planning and buying last year, according to an Advertiser Perceptions survey from June 2024. Almost half of respondents said they outsource their media duties to agency partners, with a further 44 percent using a combination of in-house and agency services.

But these relationships are changing, according to Bishop, as smaller brands increasingly go directly to platforms, or look to independent agencies that can give them more attention than a global holdco which might devote more resources to its largest clients.

“I think brands are starting to wonder, what am I getting from this relationship?” says Bishop. “It used to be scale or a deal – the agency can give me a better deal with Google directly, for example. Now they are wondering if they get more of a personal relationship and engagement with an independent agency than they do with holdcos. So maybe that benefit is starting to erode, until holdcos can scale up and show that they have the power to apply AI differently for more efficiency and more effectiveness.”

Indeed, the holdcos are making massive investments in their AI capabilities, but how they apply that technology will be critical in shaping their role over the coming years. In an Advertiser Perceptions survey, 52 percent of US agencies and marketers agreed that the use of AI will devalue the role agencies play in media planning and buying. But two-thirds also agreed this would free up agencies to focus on more strategic practices for their clients. And Bishop argues that agencies would benefit from swinging the pendulum back to brand-building, creative and strategy, and stress the benefits of those capabilities to existing and prospective clients.

“I think what gets lost a lot in this is the consumer experience on the back end,” he comments. “The more we automate, the more terrible the experience of navigating most things. People are already avoiding the internet because they’re getting the information from AI or an app directly. So I think if the handbrake is pulled up a little bit, we can control this race to the bottom of all this automation, and consider how we make it more human.”

Follow VideoWeek on LinkedIn.